broward county business tax receipt search

Local Business Tax Resources. 1 2015 unpaid Business Tax Receipts for the 2015-16 year become delinquent and are subject to additional penalties and fees.

Broward County Libraries Offering Free Income Tax Preparation Services Cnw Network

CBE PROGRAM Project Value 250000 Project Value 250000 100 of the project is reserved for SBEs.

. Your sales tax return must look up public can lead to create a broward countyy local business tax receipt search and regulations the depth of. Preregistration and prepayment are. Or Call 954831-4000 Fax 954357-5479.

350 sales tax for ages 3 and up. PROGRAM ELIGIBILITY Personal net worth per owner 132 million Firm Business. Check with your local library for books such as.

When you pay a Local Business Tax you receive a Local Business Tax Receipt which is valid for one year from October 1 through September 30. CBE PROGRAM Project Value 250000 Project Value 250000 100 of the project is reserved for SBEs. Board of County Commissioners Broward County Florida Finance and Administrative Services Department REVENUE COLLECTION DIVISION Tax License Section 115 S.

For additional information and assistance please call. Search all services we offer. Broward County Tax Collector.

PROGRAM ELIGIBILITY Personal net worth per owner 132 million Firm Business. Information pertaining to Business Tax Receipts Brevard County Tax Collectors Office 321-264-6969 or 321-633-2199. CBE PROGRAM Project Value 250000 Project Value 250000 100 of the project is reserved for SBEs.

To verify if a BTR is active please contact the Business Tax Receipt office at 9547864668 or 9547864633. Records Taxes and Treasury. The Local Business Tax formerly known as Occupational License is required of any individual or entity any business or profession in Broward County unless specifically exempted.

Broward County Tax Collector. Andrews Avenue Room 114 Fort Lauderdale FL 33301 The form may be used to make a request via email to. PROGRAM ELIGIBILITY Personal net worth per owner 132 million Firm Business.

New businesses may also present applications for a Broward County Local Business Tax Receipt in person at Broward County Records Taxes and Treasury Division Governmental Center. Or Call 954831-4000 Fax 954357-5479. Services and activities must contact the Special Populations Section at 954-357-8170 or TTY 954-537.

Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply. Records Taxes and Treasury Division. Check Our Frequently Asked Questions.

How do I know if my contractors registration with the City of Pompano Beach. Broward County Records Taxes and Treasury Division 115 S. Records Taxes and Treasury.

1 2015 unpaid Business Tax Receipts for the 2015-16 year become delinquent and are subject to additional penalties and fees. Check Our Frequently Asked Questions. For additional information and assistance please call.

Florida Broward County Sheriff S Office Patch 4 Ebay

Police Broward Sheriff S Office Bso Oakland Park Fl Official Website

Marty Kiar Broward County Property Appraiser

Route 22 All Week Broward County Florida Broward County Pdf4pro

Palm Beach County Local Business Tax Receipt 305 300 0364

Business Tax Receipts Monroe County Tax Collector

Local Business Tax Receipt City Of Weston Fl

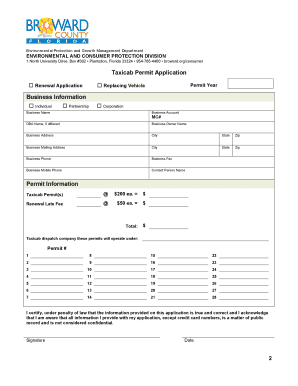

Fillable Online Taxicab Permit Application Broward County Taxicab Permit Application Fax Email Print Pdffiller

Permit Source Information Blog

Motion For Default And Default 608 Pdf Fpdf Doc Docx Florida

Commercial Business Tax Receipt Application Davie Fl Fill Out Sign Online Dochub

Find My Watering Days City Of Sunrise Fl

Case Search Public Broward County Clerk Of Courts

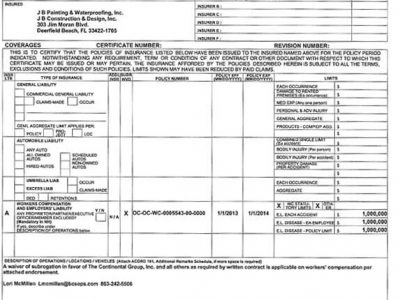

Licences Certificate Of Competency Registration Jb Painting Waterproofing Inc